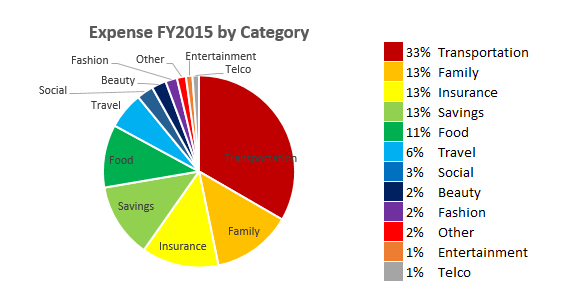

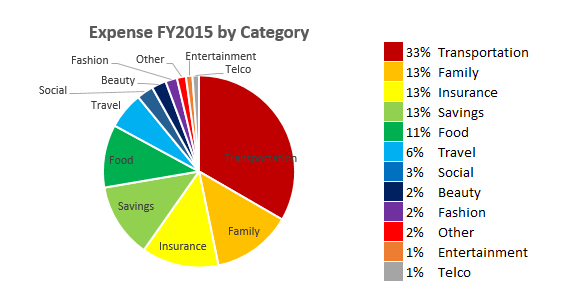

Do you know where your money go? I kinda know where my money go because when I graduated college, I was like “Oh no. No more allowance. Will I have enough every month?” I remember during that period, personal financial management was a hot topic among my peers as we embarked on this new journey. We started off with how to do budgeting and in order to stay within budget, a few of us frantically recorded our expenses every day.

So I did that with the help of a mobile app (I use Expense Manager by Bishinews) every single day for quite some time. I get lazy from time to time and probably miss out more transactions as days pass but at least I have some clue of where my money go; and touch wood, I haven’t need to borrow money from anyone yet to make ends meet even during this Big-C treatment journey.

I’d probably talk about my cancer treatment financing next time when things are sorted out because it’s still all over the place. Today, let’s take a glimpse at my personal expense before Big-C started, to reflect personal expense of an average 24-year-old marketing executive with 2-3 years working experience who is not married and living with family in Klang Valley in 2015.

33% on Transportation

Majority of my money went to Transportation! Is that a surprise in Malaysia? According to iMoney, one should spend about 15% of disposable income on transportation but mine was 33%. I lived in Klang and worked in Puchong (first half of 2015) and Bukit Damansara (second half of 2015). About 40% of my Transportation expense went to financing my car loan (Perodua Myvi) and another 45% was for petrol, toll and parking — that’s a very high cost to get to work I know but if I move out, I’d incur more cost elsewhere. Can’t wait for the MRT line near my office to be completed though I suspect there’s not much savings. FYI, my car maintenance cost was low because Perodua offered free service for 3 years.

13% on Family

I’m quite pleased to find out that my second (or third) highest expense went to Family because I always feel I don’t give my mom enough. In 2014, I gave my mom a big ang pao for CNY because I received bonus at work but last year I didn’t so I couldn’t match back. So Feb expense was higher because of CNY. May was because of mom’s birthday and Mother’s Day. And June was because RK bought a phone for my mom and I ended up paying him back. Haha.

13% on Insurance

I should be glad I spent so much on Insurance last year, shouldn’t I? Prior to Nov, I was financing a medical card and investment-linked life insurance on monthly basis via my mom because she bought the policies for me since young. In Nov, after months of procrastination and shopping, I bought a new policy myself which I paid one off (and my wallet hurt SO BAD). I’d talk about my insurance for my Big-C next time. In the meantime, go get yourself a medical card at least if you don’t have a personal medical coverage yet.

13% on Savings (Adj. ?% on Savings)

Whoa I had 13% savings. Not bad considering Forbes advises to save 10% of income, right? Except this 13% was actually short-term savings to finance my Travel expenses. LOL. So where is my actual savings? The truth is, even though I record my expenses and HAD a budget, I’m not disciplined enough to set aside a fix amount on monthly basis to build an emergency fund. Also, based on my budget, I kinda don’t have much left for additional savings *cry*. In other words, I do not have a savings plan and only save whatever that is left at the end of the month, which is not recorded just because. I can’t just take my total income minus total expense recorded because not everything was recorded. It’d be too complicated to try to figure out how much I actually saved last year so let’s just keep it a mystery.

6% on Travel (adj. 19% on Travel)

Wait. This actually means that my second biggest expense should be Travel because my Savings = Travel, making Travel 19% of my 2015 expense, right? Probably. In Jan, I went to Langkawi. In March, I renewed my passport. In July, I went to Hong Kong and in Oct, I went to Perth. I was pretty stressed up last year about the trips to Hong Kong and Perth because they were not super budget third-world country travel destinations. But thankfully, the expenses were still manageable because we were frugal. Because of the two high-cost destinations last year, we didn’t book any high-cost travel this year. And coincidentally I can’t travel too so I’m now glad that we spent the money and earned those experiences last year. LOL.

11% on Food and 11% on Others

I could have spent less on Food over weekends but oh well… Thankfully I didn’t need to change my phone last year so Telco cost was minimal — I pretty much change phone every year because my luck with phone is like that. Otherwise, I’ve learned that cost for phone should be included in Telco budget because it’s a significant expense.

That’s it! Isn’t it interesting to look at these stats and learn about one’s personal finance? I find it fascinating to churn out the charts and study my own spending behavior #nerd. Hope this fascination will keep me motivated to continue recording my expenses as much as I can.

Now let me go find my budget and see how I’ve been sticking to it.